Covered California, a health insurance marketplace, released an actuarial brief projecting the potential costs associated with coronavirus (COVID-19) testing and treatment on the national commercial health insurance markets. The analysis looked at the commercial market, 170 million Americans, including up to 20 million high-risk people under age 60 who are at higher risk of having significant health needs due to the virus.

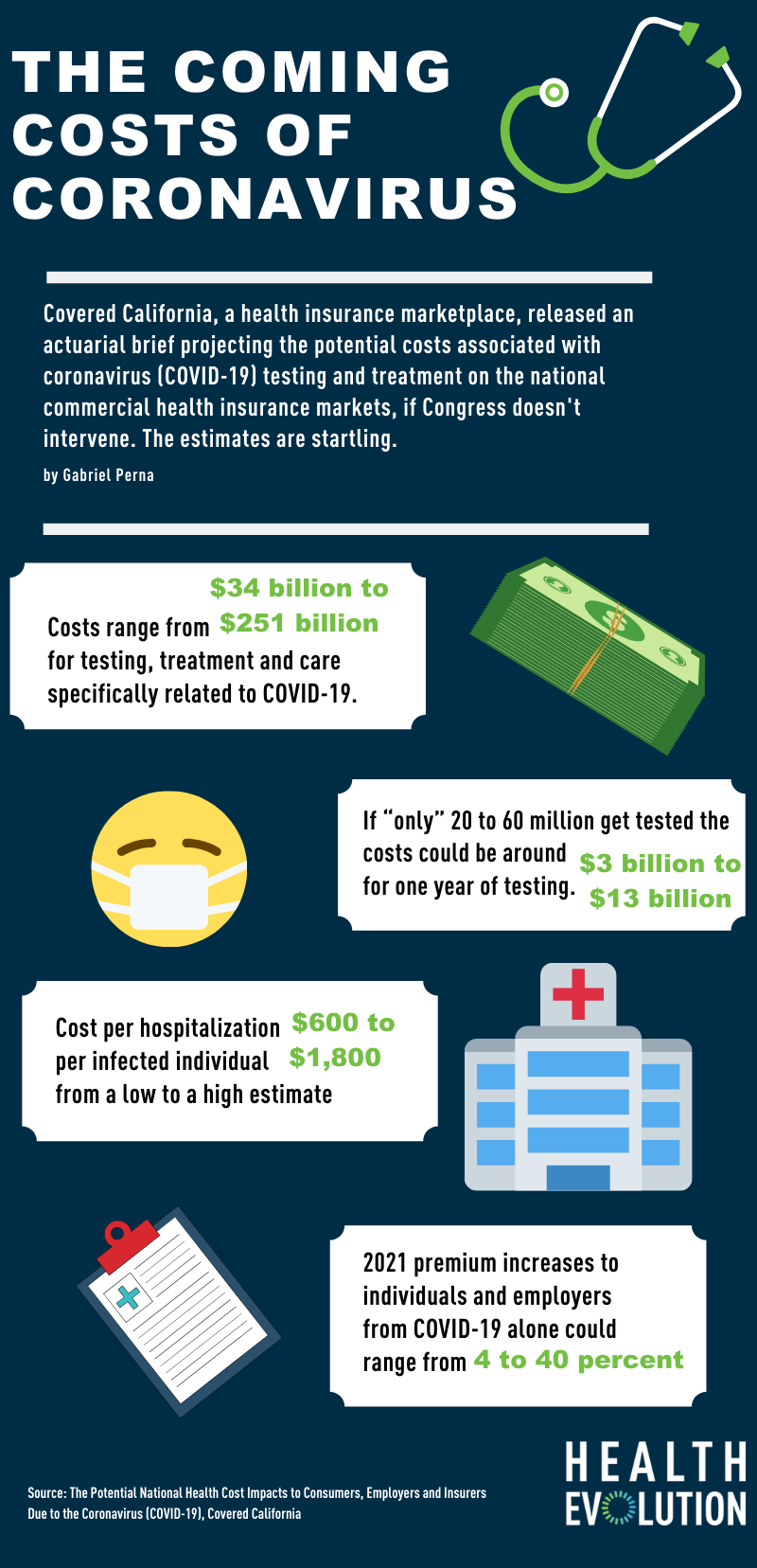

The findings are startling (see infographic above). According to estimates, costs range from $34 billion to $251 billion for testing, treatment and care specifically related to COVID-19. Those costs endured by health insurance companies would likely be impacted in 2021 health premiums.

“Covered California’s analysis shows the impact of COVID-19 will be significant, and that absent federal action, consumers, employers and our entire health care system may be facing unforeseen costs that could exceed $251 billion,” Covered California Executive Director Peter V. Lee said in a statement. “Consumers will feel these costs through higher out-of-pocket expenses and premiums, as well as the potential of employers dropping coverage or shifting more costs to employees.”

These cost estimates may get even higher in 2021, with additional treatment costs for anti-viral drug treatments and efforts to get a vaccine for COVID-19. While there are a lot of mysteries to be solved, Covered California say it’s not prudent to plan today on lower costs related to COVID-19 in the 2021 calendar year than they are projecting for 2020.

The group made suggestions to Congress, in order to mitigate the potential impact of these cost increases on consumers including the establishment of a national special-enrollment period for the individual market, a temporary program to limit the costs of COVID-19 for health insurers, self-insured employers and those they cover, and enhancing the federal financial assistance provided in the individual market to increase the level of tax credits for those earning under 400 percent of the federal poverty level (FPL).

Meanwhile, on the provider side, the costs of coronavirus are already taking their toll. With health systems largely postponing elective surgeries, revenues are guaranteed to take a hit. According to analysis from Strata Decision Technology, a health care financial analytics company, 97 percent of health systems are destined to lose an average of $2,800 per coronavirus case, with many losing between $8,000 and $10,000 per case.

Even factoring in the proposed 20% increase in Medicare reimbursement for COVID-19 patients, hospitals face an average loss of about $1,200 per case and up to $6,000 to $8,000 per case for some hospital systems. The company says many hospitals “will not be able to survive the damage to their cash flow for longer than 60-90 days.”

“Without additional financial relief from government or other sources, they will be forced to take decisive action to reduce costs such as dismissing/furloughing large numbers of non-clinical workers who are already overwhelmed converting hospital beds, maintaining equipment, and performing other non-clinical but essential jobs,” Strata says in the analysis. To help stave off this potential disaster, Strata proposes a 35% increase in Medicare reimbursement for COVID-19 patients.

Infographic source: https://hbex.coveredca.com/data-research/library/COVID-19-NationalCost-Impacts03-21-20.pdf