There is a lot of data showing provider organizations are using telehealth during the pandemic. For instance, Mass General went from 1,500 visits to more than 250,000 visits per month, according to American Telemedicine Association CEO Ann Mond Johnson. Other health systems, like Providence Health in Washington State and Partners Healthcare in Boston, saw an equally impressive jump in total visits via telehealth.

There is also data on how Medicare is using telehealth. In April, more than 40 percent of all Medicare primary care visits were done by telehealth compared to less than .1 percent in February.

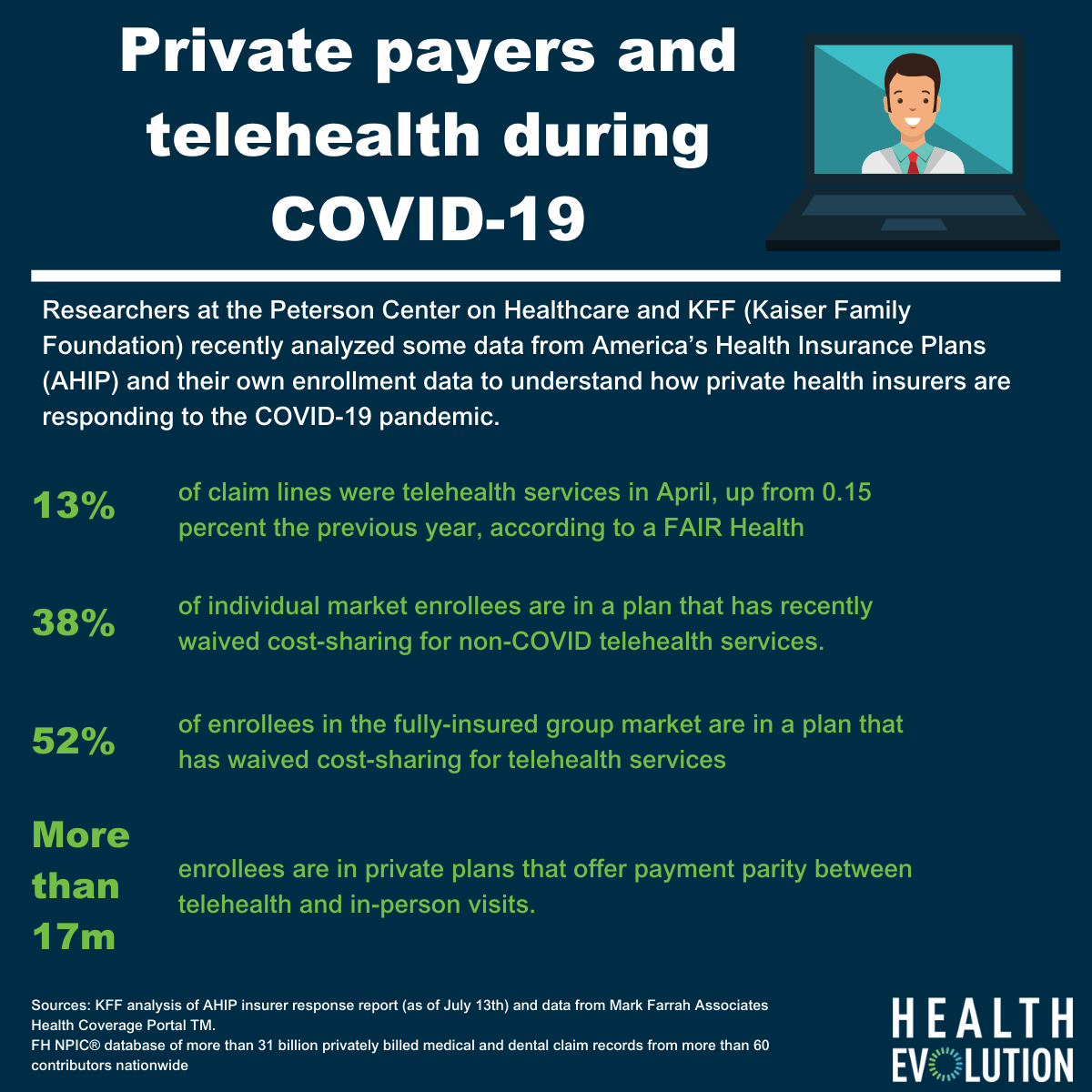

What’s less prevalent, however, has been data about how private insurers are reacting to this shift. Researchers at the Peterson Center on Healthcare and KFF (Kaiser Family Foundation) recently analyzed some data from America’s Health Insurance Plans (AHIP) and their own enrollment data to understand how private health insurers are responding to the COVID-19 pandemic.

Here are some highlights:

- Citing a statistic from Fair Health, 13 percent of claim lines were telehealth services in April, up from 0.15 percent the previous year.

- 30 million people are enrolled in individual market and fully-insured group plans that waived cost-sharing for all telehealth services (beyond COVID-19 treatment)

- 38 percent of individual market enrollees are in a plan that has recently waived cost-sharing for non-COVID telehealth services.

- 52 percent of enrollees in the fully-insured group market are in a plan that has waived cost-sharing for telehealth services

- At least 30 health plans have started including mental health and/or substance use visits in their allowable telehealth services. Also, 15 health plans expanded access to mental health and/or substance use via telehealth during COVID-19.

- More than 17 million enrollees are in private plans that offer payment parity between telehealth and in-person visits. More than 30 percent of individual market enrollees are in a plan with telehealth provider payment parity (most in states who mandate it).

A policy brief from AHIP further expanded on the telehealth impact on private health plans. The group said Blue Cross and Blue Shield of Tennessee saw 50 times more telehealth visits in May 2020 compared to their normal amount of telehealth visits.

Whether or not payment parity will last beyond the pandemic is a question that remains unanswered. The Trump administration released a proposed rule in early August that would allow Medicare to permanently cover more than 135 services through telehealth, focusing on those that impact rural health communities.